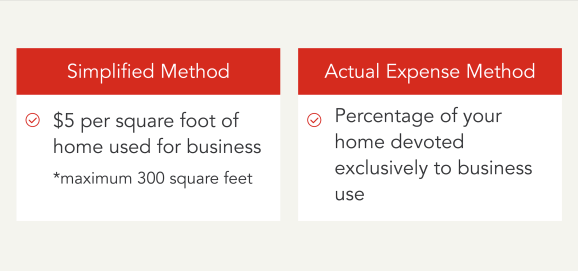

How To Deduct Home Office Expenses 2024 – Prior to 2018, remote employees could write off some of their unreimbursed home office expenses as itemized deductions, but the Tax Cuts and Jobs of 2017 suspended this tax break until 2025 [0] If . The home office tax deduction allows self-employed individuals and remote workers to deduct certain expenses related to their home office. However, not all expenses are eligible for deduction. .

How To Deduct Home Office Expenses 2024

Source : www.cnbc.com25 Small Business Tax Deductions (2024)

Source : www.freshbooks.comHere’s who qualifies for the home office deduction for 2023 taxes

Source : www.cnbc.comHome Office Deduction: How It Works, Who Can Take It NerdWallet

Source : www.nerdwallet.comHome Office Tax Deduction 2024 Blog Akaunting

Source : akaunting.comHome Office Deduction: How It Works, Who Can Take It NerdWallet

Source : www.nerdwallet.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comKeystone CPA, Inc. | Fullerton CA

Source : www.facebook.comDo I Qualify for the Home Office Deduction? Intuit TurboTax Blog

Source : blog.turbotax.intuit.com19 Tax Deductions for Independent Contractors in 2024

Source : www.deel.comHow To Deduct Home Office Expenses 2024 Here’s who qualifies for the home office deduction for 2023 taxes: However, it’s scheduled to expire in 2026. So, if you’re an employee, your home office expenses are not tax deductible — even if you do all of your work from home. “They can’t take the . work on bookkeeping or store roofing supplies — you may be entitled to deduct home office expenses from your business income. That includes whatever share of property taxes that you can assign to .

]]>